The wants of retirement investors are generally quite simple. From decades of experience, I have learned we all want high returns on our money with little or no risk. In other words, we want something we can’t have. These simple desires have cost investors billions, if not trillions, of dollars lost to scams, exaggerations, and insurance products.

I include insurance in this list because insurance companies have found a profitable tool: Preying on our fears of the future. I’m not saying that insurance investment products are necessarily bad. However, they are often sold in a slightly deceptive manner.

Take immediate annuities, for example. This product was created to appeal to those who crave a reasonably secure, predictable income in retirement. Give the insurance company a big chunk of your money, and they will “guarantee1” you an income for the rest of your life.

A dependable, lifelong income feels pretty good. For many, it may even be essential. However, I contend that most of those who purchase these income annuities are unaware of the powerful opposing arguments—salespeople rarely share the downside.

Let’s start with some assumptions. As of this writing, a $1 million, joint-life, immediate annuity for a 65-year-old couple will pay out about $4,200 per month2 for the life of both people in exchange for the million dollars upfront. After both have died, that’s it—the insurance company has no further obligation to the family.

If both die early, the insurance company keeps the remainder of the million dollars. You are betting against the insurance company, believing that you win even if one partner lives a very long time. So, what does it take to win?

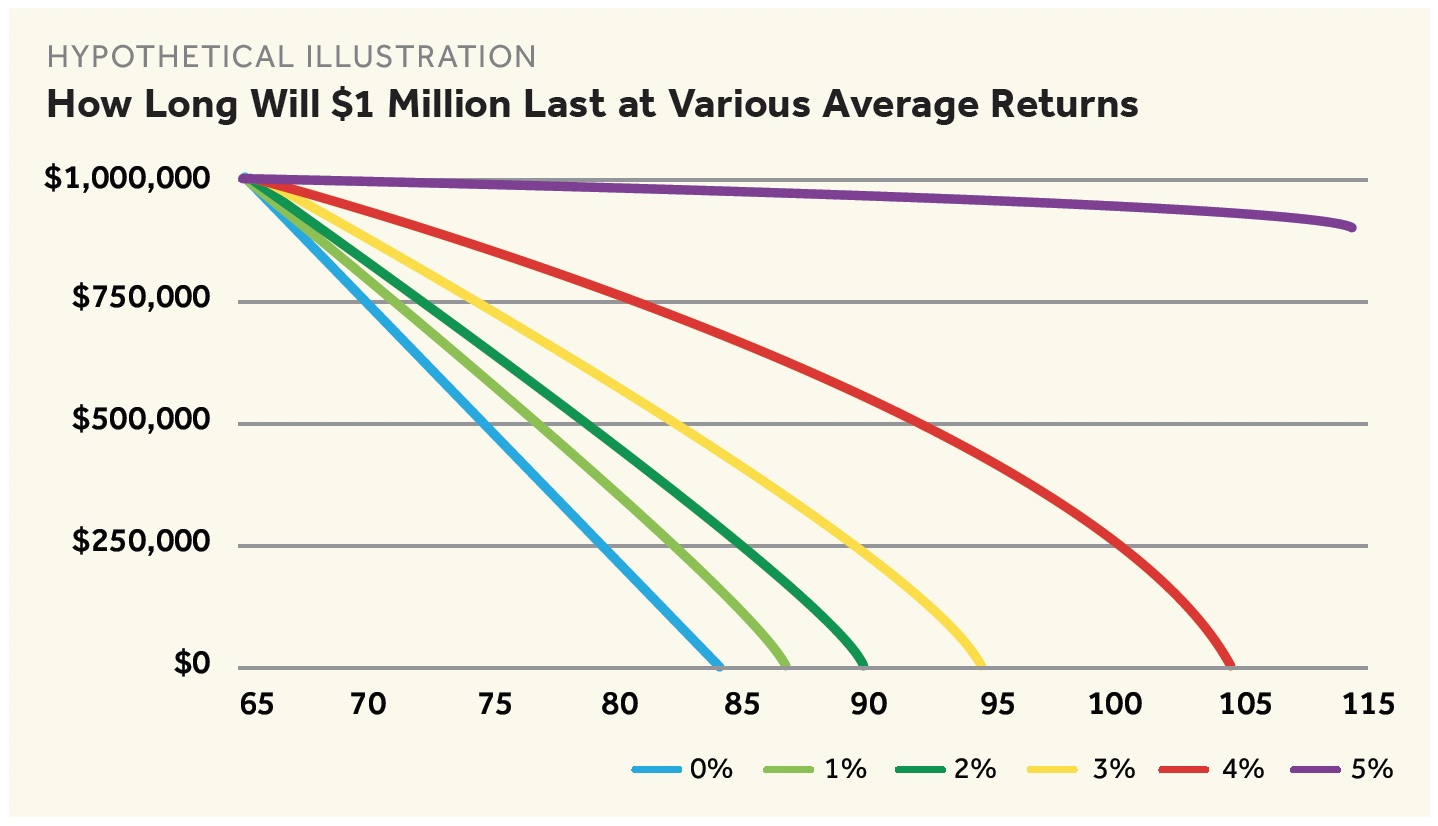

What if you put that $1 million “under the mattress,” earning nothing and slipped out $4,200 each month for expenses? How long would the money last? You would spend the last of the million bucks a bit before either of you reached your 85th birthday. If both of you die before 85, your heirs receive whatever remained hidden beneath the bedding.

Yet, the downsides of “mattress” stashing are obvious. Life past 85 will be a far more frugal affair without $50,000 a year in extra income. Social Security alone rarely provides enough for simple survival.

In our assumption, the money wasn’t making any money over those two decades. One million dollars should be able to provide some portion of your ongoing income, even when invested very conservatively.

The chart above illustrates how long $1 million would last if invested in a way to earn a small amount each year (on average), while paying out $4,200. As you can see, just earning the meager rate of 2% will extend the life of your income until age 90. Double that to 4% annually, and they’re set until well past the century mark (fewer than 1% of Americans live past 100 years old).

To give you some perspective on what mutual funds have returned in the past, I looked at two very old—because I needed 50 years of past performance to simulate a long retirement—balanced mutual funds from Vanguard: Wellesley (about 40% stocks/60% bonds) and Vanguard Wellington (about 60% stocks/40% bonds). Over the past 50 years, the average annual return of these funds has been between 9.5% and 10.3%3.

Suppose our hypothetical couple averaged about 10% per year on their million dollars. In that case, they could live until 115 and leave their heirs about $70 million. Instead, let’s be far more conservative and assume a 5% average annual return. If our couple lived until 95, they would have sustained the annuities income and died with an estate of well over $900,000.

Of course, creating your own annuity means accepting some future anxiety. Uncertainty is the hallmark of life. What you believe to be future certainty always comes with a price, although it’s often unspoken.

The host of the nationally syndicated Don McDonald Show for more than 20 years, Don now co-hosts Talking Real Money with Tom Cock on Seattle’s KOMO radio Saturdays at noon (talkingrealmoney.com) and the popular podcast of the same name. Talking Real Money is a service of Vestory by Apella. Apella Capital, LLC is an investment advisory firm registered with the Securities and Exchange Commission.

- Guarantees are based on the particular insurance company’s reserves and state guaranty associations.

- Calculated at com.

- Source: Morningstar, December 23, 2021

Data © Morningstar 2021. All rights reserved.